Explore Jarvis, the user-friendly app that streamlines pension planning for self-employed and contractors in the UK. Optimize your retirement finances effortlessly, ensuring a secure and worry-free future.

Are you a self-employed professional or contractor in the UK? Planning for your pension might seem like a daunting task, but it doesn’t have to be. With Jarvis, the UK Pensions Advisory Service, you can take control of your financial future and ensure a secure retirement. In this article, we will delve into how Jarvis can help you with your pension, Self employed pension, and Contractor pension needs.

The Importance of Pension Planning

Planning for retirement is a crucial step in ensuring financial security during your golden years. For self-employed individuals and contractors, the responsibility of pension planning often falls squarely on their shoulders. Without the support of a traditional employer, it’s essential to take proactive steps to secure your financial future.

Introducing Jarvis: Your Pensions Advisory Service

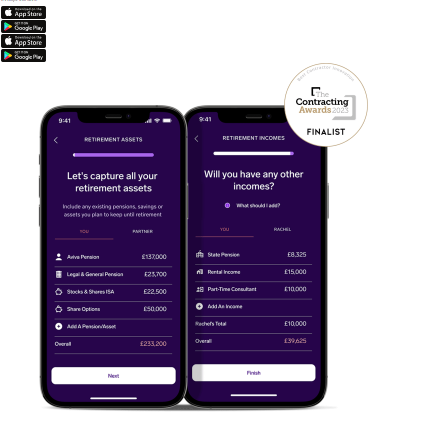

Jarvis is a user-friendly app designed specifically for individuals like you — self-employed professionals and contractors in the UK. It is tailored to optimize every aspect of planning and managing your pensions after retirement, providing you with peace of mind and financial security.

Tracking and Managing Your Pension Scheme

One of the key features of Jarvis is its ability to help you effortlessly track and manage your pension scheme. With a few clicks, you can access a comprehensive overview of your pension funds, contributions, and projected retirement income. This transparency empowers you to make informed decisions about your financial future.

Secure and Worry-Free Retirement

Jarvis’s mission is to ensure that you have a secure and worry-free retirement. By using the app’s intuitive interface, you can calculate your retirement savings goals, monitor your progress, and make adjustments as needed. This level of control allows you to take charge of your financial destiny with confidence.

Why Choose Jarvis?

User-Friendly Interface: Jarvis boasts a user-friendly interface that simplifies complex pension planning concepts, making them accessible to everyone.

Comprehensive Insights: Gain a deep understanding of your pension scheme’s performance, ensuring that your retirement funds are on the right track.

Personalized Recommendations: Receive personalized recommendations and tips to optimize your pension contributions and investments.

Financial Security: Rest easy knowing that you have a solid financial plan in place for your retirement.

How to Get Started with Jarvis

Getting started with Jarvis is easy. Simply visit us on our website https://getjarvis.app/ and explore more about how our app can revolutionize your pension planning. You can also learn more about the app’s features and benefits, as well as access our user guides and tutorials to help you make the most of Jarvis.

Conclusion

Planning for your pension, whether you’re self-employed or a contractor, doesn’t have to be a daunting task. With Jarvis, the UK Pensions Advisory Service, you can take control of your financial future, track and manage your pension scheme effortlessly, and enjoy a secure and worry-free retirement. Don’t wait; start planning for your retirement today with Jarvis — your trusted partner in pension planning.

Visit our website https://getjarvis.app/ to explore more and take the first step toward securing your financial future.

0 Comments